IPO Advisory

- Intermediary Structure

- IPO Process Chart

- Services & Solutions

- Pricings

- Success Stories

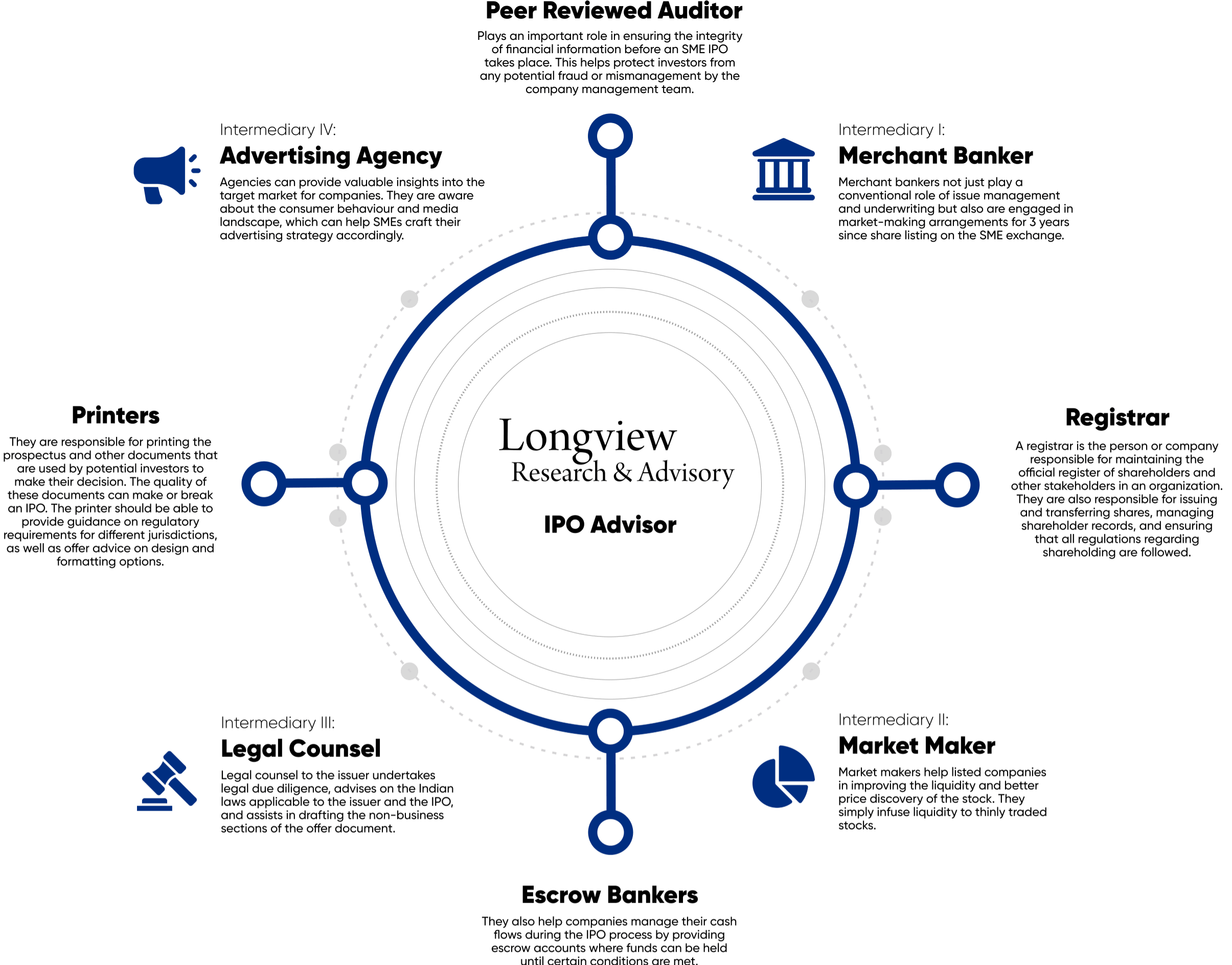

Intermediary Structure

An Initial Public Offering (IPO) is a complex process that involves a number of intermediaries. The intermediary structure of an IPO consists of investment banks, lawyers, accountants and other professionals who play a vital role in the success of the offering.

IPO Process & Intermediaries

The IPO process is a crucial step for private companies to go public and issue shares to the general public. Intermediaries like investment banks, law firms, and accounting firms play a vital role in the IPO process, from advising the company on the structure of the offering to underwriting and selling the shares to investors. These intermediaries help to ensure a successful IPO and a smooth transition to public trading.

IPO Listing Process Chart

The road to launch an IPO is a long

and technical process. One must

aware about the overview of the

process and activities involve in a

public offering.